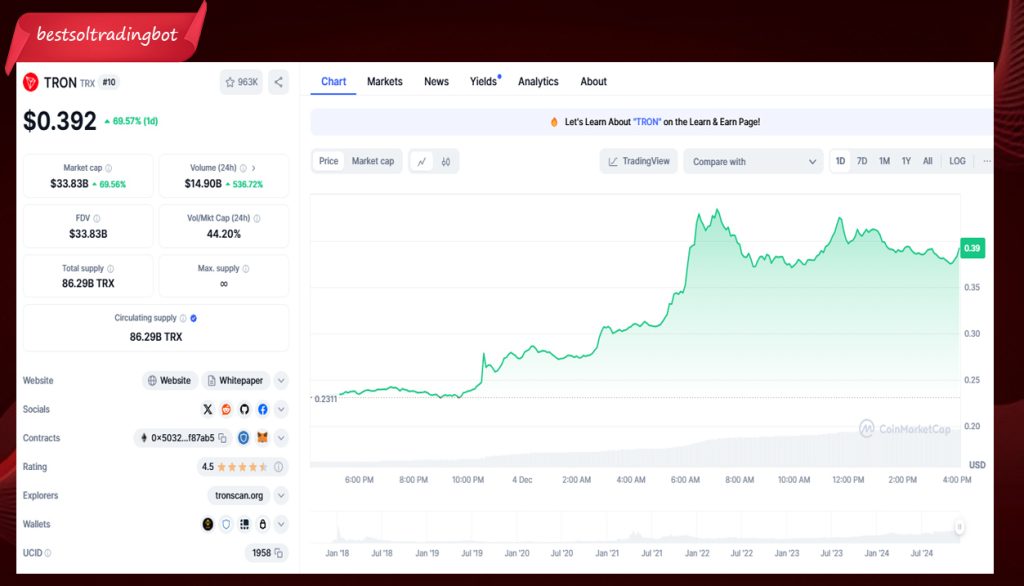

TRON’s native cryptocurrency, TRX, has recently achieved a significant milestone by surpassing its previous all-time high set in January 2018. This resurgence comes after nearly seven years of fluctuating performance, marking a pivotal moment for the TRON ecosystem. This development also raises questions about the onset of a new altcoin season, a period characterized by the outperformance of alternative cryptocurrencies relative to Bitcoin.

Contents

TRON’s Journey to a New All-Time High

Historical Performance of TRX

Launched in 2017, TRX quickly gained traction in the cryptocurrency market, reaching an all-time high of $0.30 in January 2018. However, the subsequent years saw a decline and stabilization in its price, with TRX trading below $0.05 for an extended period. This phase reflected the broader market trends and the challenges faced by emerging cryptocurrencies.

Factors Contributing to the Recent Surge

- Market Dynamics: A noticeable shift in investor focus from Bitcoin to altcoins has contributed to TRX’s price increase. Bitcoin’s dominance has been declining, creating opportunities for altcoins to capture greater market share.

- Leadership Influence: TRON’s founder, Justin Sun, has been instrumental in driving the platform’s growth. His strategic investments, such as the recent $30 million investment in World Liberty Financial (WLFI) tokens, have bolstered confidence in TRON’s prospects.

- Technological Advancements: Continuous development within the TRON ecosystem, including enhancements in decentralized applications (dApps) and smart contract capabilities, has increased its utility and appeal to developers and users alike.

Market Reactions and Community Sentiment

Community Celebrations

The crypto community has responded enthusiastically to TRX’s new all-time high. Influencers like MMCrypto have highlighted TRX’s perseverance, noting that it took seven years to surpass its previous peak, a testament to its resilience.

Impact on TRON-Based Tokens

The surge in TRX’s value has positively affected TRON-based tokens, particularly memecoins such as SUNDOG and TBULL, which have experienced significant gains in the past 24 hours.

Indicators of an Approaching Altcoin Season

Bitcoin Dominance and Market Capitalization Shifts

A decline in Bitcoin’s market dominance often signals the onset of an altcoin season. Recent trends indicate that Bitcoin’s dominance is waning, allowing altcoins to gain traction and increase their market share.

Performance of Other Altcoins

Several altcoins have shown impressive performance, with Hedera (HBAR) logging over 600% gains, Stellar (XLM) at 515%, and Ripple (XRP) at 402% over the past 90 days. These trends suggest a broader altcoin rally.

Investor Behavior and Market Sentiment

Investors are increasingly diversifying their portfolios to include altcoins, driven by the potential for higher returns. Sentiment analysis indicates growing interest in alternative cryptocurrencies, further supporting the likelihood of an impending altcoin season.

Potential Altcoins Poised for Breakout

Uniswap (UNI)

- Recent Performance: UNI has demonstrated robust growth, reflecting increased activity in decentralized finance (DeFi) platforms.

- Contributing Factors: The rise of decentralized exchanges (DEXs) and UNI’s role in facilitating seamless token swaps position it favorably for future gains.

Stellar (XLM)

- Growth Statistics: XLM has achieved a 515% increase over the past 90 days, indicating strong market interest.

- Key Developments: Partnerships aimed at enhancing cross-border payment solutions have strengthened Stellar’s market position.

Other Notable Altcoins

- Solana (SOL): Known for its high-speed transactions and scalability, Solana is approaching its all-time high, driven by growing adoption in various sectors.

- Binance Coin (BNB): As the native token of the Binance exchange, BNB benefits from the platform’s expansive ecosystem, contributing to its upward trajectory.

Expert Insights and Predictions

Analyst Perspectives

Market analysts suggest that the current altcoin rally is sustainable, provided that technological developments and user adoption continue to progress.

Future Outlook

Predictions indicate that the altcoin season could extend into 2025, with potential challenges including regulatory changes and market volatility. Investors are advised to conduct thorough research and consider diversification to mitigate risks.

Conclusion

TRON’s achievement in surpassing its previous all-time high signifies a notable development in the cryptocurrency landscape. This event, coupled with the performance of other altcoins, suggests the potential onset of an altcoin season. As the market evolves, continuous monitoring and informed decision-making remain crucial for investors navigating this dynamic environment.

Frequently Asked Questions

What is TRON (TRX)?

TRON is a blockchain-based platform focused on building a decentralized internet. Its native cryptocurrency, TRX, is used to power applications on the network.

What is an altcoin season?

Altcoin season refers to a period when alternative cryptocurrencies outperform Bitcoin in terms of price appreciation.

How can investors identify an approaching altcoin season?

Indicators include a decline in Bitcoin’s market dominance, significant gains in altcoin prices, and increased investor interest in alternative cryptocurrencies.

What factors contributed to TRX’s recent surge?

Factors include a shift in investor focus from Bitcoin to altcoins, strategic investments by TRON’s leadership, and technological advancements within the TRON ecosystem.

Which altcoins are poised for a breakout?

Altcoins such as Uniswap (UNI), Stellar (XLM), Solana (SOL), and Binance Coin (BNB) are showing potential for significant gains based on recent performance and market developments.

Disclaimer

The information provided in this article is for informational purposes only and should not be construed as financial advice. Cryptocurrency investments carry significant risk due to market volatility. Readers are advised to conduct thorough research and consult with financial advisors before making any investment decisions.

References