Thinking about automating your crypto trading with Kryll? You are in the right place. This in-depth kryll trading bot review cuts through the noise to deliver a clear analysis of its features, performance, and overall value. We will explore its unique visual strategy editor, marketplace, and pricing model. Our goal is to provide the clarity you need to decide if Kryll is the right automated tool to elevate your investment strategy in today’s dynamic market.

Contents

What is Kryll and how does it work

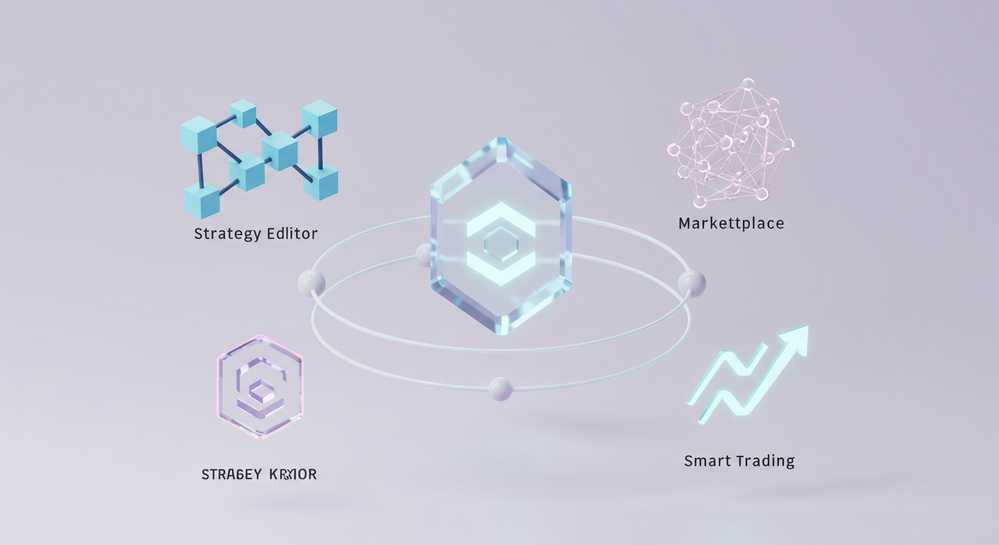

This Kryll trading bot review introduces an automated trading platform built for accessibility. Kryll empowers traders to execute complex crypto strategies 24/7 without writing a single line of code. It operates by connecting to your preferred exchanges, such as Binance or KuCoin, via secure API keys. This allows the platform to manage trades on your behalf based on the logic you define. The core principle is to make automated trading visual and intuitive for everyone.

The platform’s workflow is designed for clarity and control. Users begin by creating a strategy in the visual editor, connecting blocks that represent indicators and actions. This no-code approach is simpler than understanding how AI trading bots learn, giving you direct command over the logic. Before deployment, every strategy can be rigorously backtested against historical data. This crucial step helps you refine your bot and assess its potential effectiveness before committing real funds to the market.

- Visual Editor: Build trading bots by dragging and dropping predefined blocks for triggers, indicators, and actions.

- Marketplace: A community hub to rent successful strategies from others or lease your own creations for passive income.

- Smart Trading: An interface for setting advanced orders like trailing stops without launching a full strategy.

Key features that make Kryll stand out

Kryll distinguishes itself with a user-centric design and several unique functionalities. These features cater to a wide spectrum of traders, from beginners seeking a simple entry point to experts wanting to monetize their skills. This approach is a core reason for its positive reception in many a Kryll trading bot review. The platform successfully lowers the barrier to entry for automated crypto trading while providing powerful tools for seasoned users, creating a balanced and robust ecosystem.

The strategy marketplace

The Kryll Marketplace is a community-driven hub where users can rent trading strategies. This is a significant advantage for novices who lack the time or confidence to build their own bot. Each strategy transparently displays its historical performance, helping you choose one that fits your risk tolerance. Conversely, experienced traders can publish their successful strategies to earn passive income in KRL tokens, fostering a collaborative environment where expertise is rewarded and shared.

Intuitive drag and drop editor

The platform’s signature feature is its visual editor. It transforms the complex process of bot creation into a simple drag-and-drop flowchart. You can visually combine technical indicators like RSI and MACD with logical operators and actions such as buy or sell. This “What You See Is What You Trade” method makes building and understanding a strategy’s logic highly intuitive, removing the need for any programming knowledge and opening up algorithmic trading to a much broader audience.

Kryll pricing structure explained

Kryll operates on a flexible Pay-As-You-Go model, a critical factor in any Kryll trading bot review. This means you avoid fixed monthly subscriptions and only pay for the resources you actually use. Costs are calculated based on the duration a bot is active and the capital it manages. The platform’s native KRL token is central to this system, offering significant discounts on fees and incentivizing participation within its ecosystem. This model is particularly attractive for newcomers.

This pricing structure is highly cost-effective for users who are just starting or trade infrequently. However, for high-frequency traders, the usage-based costs can accumulate. It is essential to calculate potential expenses based on your intended trading volume before committing significant capital. This ensures the fee model aligns with your strategy’s profitability goals.

- Live Trading Fees: Calculated based on the time a strategy is active and the capital allocated, typically billed daily.

- Backtesting Fees: A small fee is charged for testing strategies against historical data, based on the test period.

- KRL Token Benefits: Holding and using KRL tokens in your platform wallet unlocks reduced fees and other perks.

Pros and cons of using the Kryll bot

To provide a balanced perspective, this Kryll trading bot review examines the platform’s strengths and weaknesses. Understanding these trade-offs is crucial for making an informed decision that aligns with your specific trading needs and experience level. No single automated tool is perfect for every investor, and this platform is no exception. Evaluating both sides will help clarify if its features are the right fit for your strategy.

Pros of using Kryll

- User-Friendly Interface: The visual drag-and-drop editor is a standout feature, making bot creation highly accessible to non-coders.

- Vibrant Marketplace: It offers a great resource for beginners to access proven strategies and for experts to monetize their knowledge.

- No Subscription Fees: The pay-as-you-go model is flexible and appealing for those who do not want a fixed monthly commitment.

- Strong Community Support: Kryll has an active community on platforms like Telegram, offering help and strategy ideas to new users.

Cons of using Kryll

- Potentially High Costs: The usage-based fee can become expensive for high-frequency or high-volume strategies compared to flat-fee competitors.

- Advanced Strategy Learning Curve: While basics are simple, creating a truly sophisticated and profitable bot requires a deep understanding of trading.

- Performance Dependency: The success of rented marketplace strategies depends entirely on the skill of their creators and volatile market conditions.

Kryll offers a compelling and accessible entry into the world of automated crypto trading, especially for beginners, thanks to its visual editor and robust marketplace. While its pay-as-you-go model is flexible, high-volume traders should carefully calculate potential costs. If you value ease of use and a strong community, Kryll is a formidable contender. For more insights and comparisons with other leading platforms, explore the resources at Best Sol Trading Bot.